11 Oct The Dividend Kings of the Indian Stock Market: Top Dividend-Yielding Stocks

It’s always of high interest to dividend investors, to find the best stocks that offer regular and steady dividends, and in the Indian stock market, there are some big players that really stand out. But if like me, you’re an investor who wants more than just capital gains but regular income from the investments we have made then you must be glad to know that there are several Indian Companies that are rated as “Dividend Kings”. A quality portfolio containing these stocks offer mouthwatering dividend yields thus giving investors an opportunity to earn their money back at the worst of times. You can check dividend declared for stocks by clicking here:

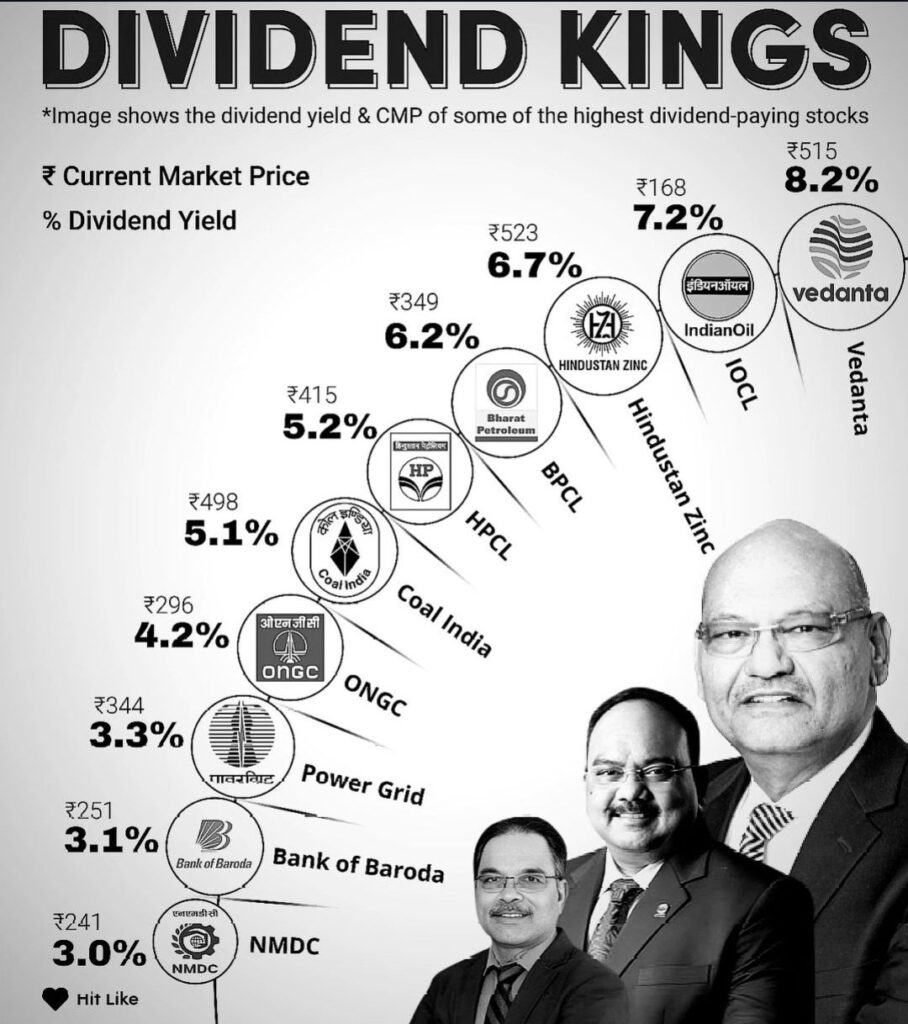

Let’s break down some of the top dividend-paying stocks from the attached infographic:

1. Vedanta Ltd (₹515 | 8.2%)

The leader of the pack is Vedanta which is a diversified natural resources business. Oh definitely and to top it up the current dividend yield is 8.2% making the company a darling of investors in hunt for yield. Big yields mean that the firm places emphasis on paying out dividends and Vedanta’s long history of doing exactly this makes it a ideal stock to own for income generation.

2. IOCL Ltd (₹168 | 7.2%)

In the next place we have IOCL one of the largest state owned oil companies in India. Indian Oil provides a yield of 7.2% which is good a dividend income to the investor. That is because its role in the oil sector and government support provide stability to the stock in terms of risk and profitability.

3. Hindustan Zinc (₹523 | 6.7%)

A yield of 6.7% is offered by Hindustan Zinc, which operates as one of the world’s largest integrated producers of zinc-lead and silver. This is another stock that has a good yield which is an indication that it is in a position to generate excellent cash revenues from its operations; thus, another winner in a world of dividends.

4. BP Refinery Limited (Chennai, India) (₹523 | 6.2%)

A big oil refining and marketing company of the Indian soil BPCL is offering a yield of 6.2%. Strong cash generating capability and sound revenue models provide BDIs that are large and consistent making government-owned companies like BPCL suitable for the conservative investor.

5. Hindustan Petroleum Corporation Limited (HPCL) (₹415 | 5.2%).

Similarly another oil and gas company HPCL gives quite a good average yield of 6.2% on the given cost. That is why HPCL has a fairly stable approach to the payment of dividends, which makes it good for investing in a company that offers good dividends in the long term.

6. Coal India (₹498 | 5.1%)

Currently coal India which is a world largest coal miner has a dividend yield of 5.1%. Being a public sector entity it gives good dividends whether it is because of its huge reserves or the market leader status inIndian coal markets. It still is a favorite among investors that prefer steady cash flow returns on their investments.

7. Oil and Natural Gas Corporation (ONGC) (₹296 | 4.2%)

Another giant of energy sector – ONGC provides some 4.2% of yield. The operating cash flows of the company remain high and it is involved in oil and gas exploration, so the returns on dividend seem quite secure because of government support.

8. Power Grid Corporation (₹344 | 3.3%)

Power Grid that pays a dividend of 3.3% is central to transmitting power throughout the country. Due to its location, favorable operations and attractive earnings it would be an ideal candidate for income focused investors seeking a play on the utilities space.

9. Bank of Baroda (₹251 | 3.1%)

The yield in the public sector bank like Bank of Baroda is 3.1%. Thus, on the fragile grounds of the banking sector and particularly with regards to public sector bank, appreciable dividend yield means easy earnings for the investor intending to invest in the financial sector.

10. NMDC (₹241 | 3.0%)

Last but not least, we have NMDC which is a public sector mining company and their prospective dividend yield 3.0%. Through dividends, NMDC provides stable revenues to its shareholders due to a constant, year after year, output in iron ore production and is a worthy addition to the investment portfolio.

Dividend paying stock has been an investment avenue that many investors seek to tap in due to the following factors;

Companies that pay dividend to their shareholders offer a way through which investors can earn a predictable and steady rise. During volatile business situations, dividends help guide the investor back to the safe zone, where even though returns may not soar high, at least they are guaranteed something from their investment even without having to deal with soaring high stock prices. Further, the policy of reinvesting the dividends canof course benefit in compounding of growth in totality of returns.

That NMDC or Vedanta has emerged as the preferred choices of many investors is evident from most of the stocks identified above; dividend is a key wealth creator. These are global giant corporations operating in set industries and which provide reliable and competitive returns on investment. If you’re interested in making some more diverse investments and adding stocks that are also capable of providing you with dividend income, these ‘Dividend Kings’ are worth following.

If you are an income investor with an investment horizon over many years you can topple up a substantial extra income stream just with high dividend yield companies from reliable sectors In addition if you are concerned about volatility in the market additional.Its difficult to suggest high dividend stocks from safe sectors because different investors have different risk profiles and choose different sectors with different optimism.

This blog is for the purpose of sharing information and should not be viewed as financial advice. As always, you are advised to seek professional advice or to do independent research before investing.

Surabhi Sinha

Posted at 12:34h, 11 OctoberSuper nice blog thanks for sharing

Devika

Posted at 13:03h, 11 OctoberSuper surabhi great article

Pingback:Top Microcap Multibagger Stocks Held by Mutual Funds: High-Growth Opportunities - cashcompounds.com

Posted at 06:17h, 16 October[…] Investors are advised to maintain a diversified portfolio to mitigate risk. You can check Dividend kings of Indian stock market […]